We need a banking revolution

The motive behind these recommendations has been my

growing unease, over the past fifteen years, with the way that ‘sophisticated’ finance has developed into a self-serving, self-congratulating culture – voting itself rewards that are too high and, by implication, cannibalising other parts of the economy.

This is not a rant against millionaires and others who have

made and enjoy their own wealth. Nor against those who

by some fluke of regulation found that the rules worked in

their favour and made them rich. This would not be a revolution against capitalism, but it would be a revolution in favour of the more efficient use of capital and in favour of a fairer distribution of the real costs and benefits of financial services.

The failures of modern banking

Excessive complexity

"The direction of bank reform since the 2008 crisis has not inspired confidence. There are glaring failures: the failure to simplify the complexity," and

A culture gap

"Failure to change the culture that permeates the world of finance."

Over-leverage

"Highly leveraged investment banks have been able to present a less

frightening picture of themselves by using the concept of risk weighted

assets (RWAs)."

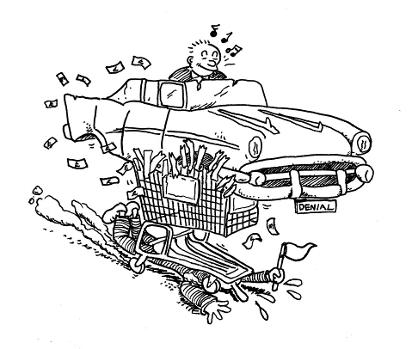

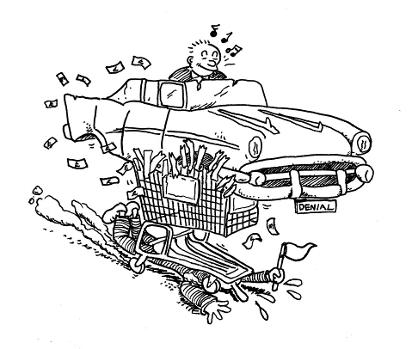

The curse of the bonus

"The bonus still plays a big part in

negotiations and performance assessments every year. It influences employees’ behaviour, and their attitude to senior management, to clients, to each other. It is the curse of modern

banking."

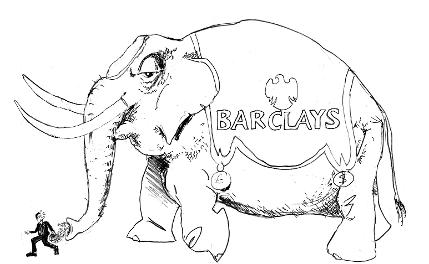

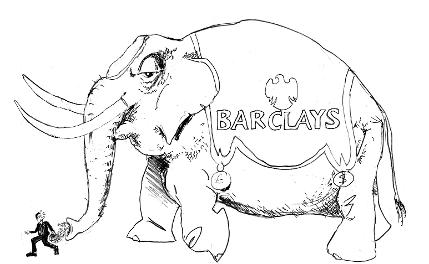

Regulatory capture

"Since 1988, bank regulators have been led a merry dance trying to devise rules that constrain what complex banks are doing. In the process, it is arguable that they have been ‘captured’ themselves."